United Overseas Bank (SGX:U11), or UOB for short, shouldn’t be unfamiliar to you as well – in fact, many of us should also have a bank account with them. The bank also happens to be one of the largest in Southeast Asia by total assets. Apart from Singapore (where its global headquarter is located), it also has a business presence in the following countries – Australia, Brunei, Canada, China, France, Hong Kong, India, Indonesia, Japan, Malaysia, Myanmar, Philippines, South Korea, Taiwan, Thailand, United Kingdom, United States of America, and Vietnam.

I’ve made my investment decision on the Singapore bank back in early-March 2020, when its share price fell to my buy target price of $23.26 – based on this price, along with its dividend payout of 130.0 cents/share in FY2019, the yield was 5.6% (which satisfied my requirement of a yield of at least 4.0% for all of my investments.)

No doubt its share price took a huge dive (by $5.98, or 25.7% from my buy price) shortly after due to the Covid-19 pandemic, I held on to my positions (the only pity was I did not increase my investments in the bank at that point in time to bring down my average price, and at the same time, bring up the yield) for the bank’s underlying business fundamentals continued to remain intact.

Eventually, with the introduction of several vaccines, countries starting to lift their lockdown restrictions after hitting their vaccination targets, and normal business activities resuming once again, the share price of UOB recovered – and as at the time of writing, I’m currently sitting on a unrealised capital gain of about 15.0% (this excludes the dividends I’ve received throughout the entire period as a shareholder of the Singapore bank) – which is pretty decent in terms of returns over a period of close to 2 years in my opinion.

So, why did I made the investment in UOB in the first place? In my post about the Singapore bank today, you’ll read about some of its key financial performances, statistics, along with its dividend payouts declared to its shareholders over the past 9 years (between FY2012 and FY2020.) On top of that, you’ll also read about my outlook for the bank in the coming year ahead.

Without further ado, let’s get started…

Key Financial Performances

Some of the key financial performances I will be looking at in this section are its total income (which comprises of 3 components – net interest income, net fee and commission income, and other non-interest income), along with its net profit recorded over a period of 9 years (between FY2012 and FY2020), in the table and chart below:

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| – Net Interest Income (S$’mil) | $3,917m | $4,120m | $4,558m | $4,926m | $4,991m |

| – Net Fee & Commission Income (S$’mil) | $1,508m | $1,731m | $1,749m | $1,883m | $1,931m |

| – Other Non- Interest Income (S$’mil) | $1,070m | $870m | $1,151m | $1,238m | $1,140m |

| Total Income (S$’mil) | $6,495m | $6,720m | $7,457m | $8,048m | $8,061m |

| Net Profit (S$’mil) | $2,803m | $3,008m | $3,249m | $3,209m | $3,096m |

| FY2017 | FY2018 | FY2019 | FY2020 | ||

| – Net Interest Income (S$’mil) | $5,528m | $6,220m | $6,563m | $6,035m | |

| – Net Fee & Commission Income (S$’mil) | $1,873m | $1,967m | $2,032m | $1,997m | |

| – Other Non- Interest Income (S$’mil) | $1,162m | $930m | $1,435m | $1,144m | |

| Total Income (S$’mil) | $8,563m | $9,116m | $10,030m | $9,176m | |

| Net Profit (S$’mil) | $3,390m | $4,008m | $4,343m | $2,915m |

The bank’s net interest income saw a good consistent growth every single year over the past 9 years I’ve looked at (except for FY2020, due to policymakers across the regional markets reducing interest rates to provide support to the economy and market liquidity as a result of the Covid-19 pandemic.) The same can be said for its net fee and commission income as well – where it recorded year-on-year (y-o-y) improvements in all but two years (in FY2017, as well as in FY2020 – with decline in the latter due to consumers spending less on credit cards, along with a reduction in business activities due to movement restrictions and social distancing measures in place to slow down the transmission of Covid-19.) In terms of its compound annual growth rate (CAGR), its net interest income grew at a CAGR of 5%, while its net fee and commission income improved at a CAGR of 3%.

However, its non-interest income saw some slight declines in 4 out of 9 years I’ve looked at – in FY2013 (as a result of a 19.2% decline in trading income and investment income on lower gains from the sale of securities due to market volatility, as well as concerns on US quantitative easing tapering), in FY2016, in FY2018 (due to unrealised mark-to-market on investment securities and lower gains from the sales of investment securities), as well as in FY2020 (due to lower net trading income on the back of a volatile market in the year.) As such, this business segment only saw a modest CAGR of 1% over a 9-year period.

Finally, the bank’s net profit saw declines in 3 out of 9 years – in FY2015 (due to a 5.7% y-o-y increase in total allowances to $672m), in FY2016 (due to a decline in its other non-interest income), as well as in FY2020 (due to a huge spike in total allowances for credit and other losses amounting to S$1,554m.)

Key Financial Statistics

The following table is UOB’s net interest margin, return on equity, and its non-performing loans rate recorded over the past 9 years (and these are the 3 key financial statistics I focus my attention on whenever I study about a bank):

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Net Interest Margin (%) | 1.87% | 1.72% | 1.71% | 1.77% | 1.71% |

| Return on Equity (%) | 12.4% | 12.3% | 12.3% | 11.0% | 10.2% |

| Non-Performing Loans Rate (%) | 1.5% | 1.1% | 1.2% | 1.4% | 1.5% |

| FY2017 | FY2018 | FY2019 | FY2020 | ||

| Net Interest Margin (%) | 1.77% | 1.82% | 1.78% | 1.57% | |

| Return on Equity (%) | 10.2% | 11.3% | 11.6% | 7.4% | |

| Non-Performing Loans Rate (%) | 1.8% | 1.5% | 1.5% | 1.6% |

My Observations: The bank’s net interest margin has been quite consistent in my opinion – where it moved in the range of 1.7+% on most years. However, in the year 2020, it fell to 1.57% (which is also the lowest in 9 years) due to the central bank cutting interest rates to support economies amid the Covid-19 pandemic.

Its return on equity also fell from a high of 12.4% in FY2012 to a low of 10.2% in both FY2016 and FY2017 (not only that, but this particular statistic also recorded a steady decline between the 2 periods) before recovering in the subsequent 2 years, and then falling again to a low of just 7.4% in FY2020 due to the Covid-19 pandemic (which is also a 9-year low.)

Finally, the bank’s non-performing loan rates have been at 1.5% or lower in most years – the only 2 years where its non-performing loans rate went about 1.5% were in FY2017 and in FY2020.

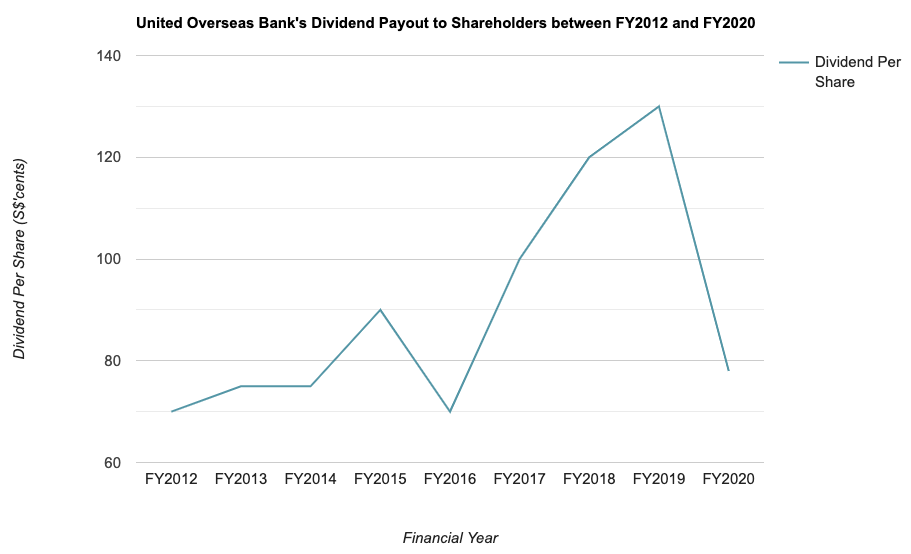

Dividend Payout to Shareholders

UOB have been paying out its shareholders on a half-yearly basis throughout the entire 9-year period I’ve look at – once when it releases its second quarter results (known as interim dividend), and once when it releases its fourth quarter and full-year results (known as final dividend.)

The following is its payout to shareholders recorded between FY2012 and FY2020, along with its payout ratios:

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Dividend Per Share (S$’cents) | 70.0 cents | 75.0 cents | 75.0 cents | 90.0 cents | 70.0 cents |

| Dividend Payout Ratio (%) | 40.9% | 40.8% | 38.1% | 46.6% | 37.8% |

| FY2017 | FY2018 | FY2019 | FY2020 | ||

| Dividend Per Share (S$’cents) | 100.0 cents | 120.0 cents | 130.0 cents | 78.0 cents | |

| Dividend Payout Ratio (%) | 50.5% | 51.5% | 51.2% | 46.4% |

The bank’s dividend payout saw y-o-y declines in 2 out of 9 years – in FY2016 (in-line with a decline in its net profit for that financial year), as well as in FY2020 (as the are being advised by the Monetary Authority of Singapore to cap their dividend payout to 60.0% of what was paid out in FY2019.) If I were to include its payout for FY2020, then its dividend payout would have grown at a CAGR of just 1%; however, if I were to exclude the payout declared in FY2019, then over a 8-year period (between FY2012 and FY2019), its dividends have grown at a CAGR of an impressive 8%.

In terms of its dividend payout ratio, over the years, it has been no more than slightly more than 50.0% – and from my understanding, the bank will continue to pay out dividends at this ratio.

Closing Thoughts

UOB’s stable financial performance over the years, along with its growing dividend payouts to its shareholders, are reasons why I’ve invested in the Singapore bank. If I had to name one thing that’s not so ideal, it’ll be the declining return on equity recorded over the years.

Looking ahead, I am of the opinion that as countries slowly reopen their economy after hitting their vaccination targets, the bank’s performance should see further improvements in the year 2022 with more business activities, and this should lead to a better set of result reported by the bank – this is provided the newly discovered Omicron variant does not lead to countries re-imposing blanketed lockdowns once again – which will lead to economic activities being stalled and negatively impacting the bank’s performance (having said that, I feel that the chances of this happening once again is minimal at this point in time.)

That concludes my review of UOB’s performances and dividend payouts to its shareholders over the last 9 years, along with my outlook for the bank in the coming year ahead. I do hope that you’ll find the information presented above useful and before I end, a gentle note that everything you’ve just read above is purely for educational purposes only, and they do not represent any buy or sell calls for the bank’s shares. As always, please do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am a shareholder of United Overseas Bank Limited.

Join Me 'Live' at REITs Symposium 2025 – 24 May | 3:15PM – 3:45PM @ Engagement Stage

Amid escalating trade tensions and renewed market volatility triggered by the latest wave of tariff announcements, how should investors navigate the REITs space?

I'll be sharing my insights and strategies for staying resilient with REIT investments in these uncertain times during my presentation at the Engagement Stage — located right at the entrance of the event.

🎟️ Find out more about the event, and grab your tickets for just S$5 here...

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (0)