I am invested in a total of 3 REITs and business trusts sponsored by CapitaLand Investments Limited (SGX:9CI) – CapitaLand Ascendas REIT (SGX:A17U), CapitaLand India Trust (SGX:CY6U), and CapitaLand Integrated Commercial Trust (SGX:C38U). All 3 of them have financial years ended 31 December, and you can find my review of their results for the 2nd half, as well as for the full year here.

Among the 3, CapitaLand India Trust was the first to publish its annual report yesterday (25 March 2024) morning – for the benefit of those who are hearing about this business trust for the first time, as the name suggests, it is focused on investing in properties in India (where the country is the 5th largest economy in the world, according to a report from Investopedia on 15 December 2023 here).

At the time of writing, the business trust owns 9 world-class IT business parks, 4 industrial and logistics facilities, as well as 4 data centre developments in 5 top tier cities in the country (Bangalore, Chennai, Hyderabad, Mumbai, and Pune) valued at S$3.0 billion as at 31 December 2023. CapitaLand India Trust is focused on capitalising on the growing IT industry, industrial and logistics asset class, and new economy asset classes such as data centres.

In this post, you will find key pointers to take note of in the annual report, along with details of its upcoming annual general meeting (or AGM for short)…

Summary of CapitaLand India Trust’s Annual Report

Property Portfolio:

- By Valuation: IT Parks (88%), Industrial/Logistics Facilities (8%), Data Centres (6%)

- By Total Floor Area: IT Parks (85%), Industrial/Logistics Facilities (10%), Data Centres (5%)

- No. of Properties in Each City: Bangalore (2), Chennai (5), Hyderabad (4), Mumbai (3), and Pune (2)

Key FY2023 Performance Highlights:

- Total property income and net property income rose by 11.1% and 7.7% to S$234.1m and S$179.6m respectively, as a result of higher rental income from existing properties and partial income recognition from newly acquired properties.

- Despite the strong underlying performance, Distribution Per Unit (DPU) for the year fell by 21.2% to 6.45 Singapore cents, mainly due to an enlarged unit base resulting from the preferential offering in July 2023, higher financing costs, and the depreciation of the Indian Rupee (INR) against the Singapore Dollar.

- Portfolio occupancy was up slightly to 93% (from 92% last year), which can be attributed to strong demand from global multinational corporations (MNCs) and prominent local Information Technology (IT) companies for its business parks throughout the year.

- Gearing ratio have improved to 35.8% as at 31 December 2023 (compared to 40% as at 30 June 2023), contributed by a 20% increase in valuation in its properties. The business trust now has a healthy debt headroom of about S$1.1 billion to support its future growth initiatives.

Strategic Growth & Expansion Efforts:

- In January 2023, CapitaLand India Trust announced the proposed acquisition of a 1.0 million sq ft IT Park at Outer Ring Road, Bangalore, a high growth micro-market, as well as the completed redevelopment of 1.4 million sq ft International Tech Park Hyderabad (ITPH) Block A, which achieved full occupancy from leases to reowned global corporations such as Bristol Myers Squibb, Ernst & Young, Tata Consultancy Services, and Warner Bros.

- In May 2023, the business trust completed the acquisition of International Tech Park Pune – Hinjawadi (ITPP-H), an IT Special Economic Zone (SEZ) spanning 2.3 million sq ft from the Sponsor.

- In December 2023, CapitaLand India Trust completed the acquisition of 2 industrial facilities at Mahindra World City, Chennai, known as Casa Grande – Phase 2 – this property includes 2 fully-leased industrial facilities totalling 0.3 million sq ft, with a leading international electronics contract manufacturer and a global energy solutions partner as tenants.

Active Development Pipeline:

The following developments, upon completion, are expected to contribute positively to CapitaLand India Trust’s income and strengthen its portfolio resiliency:

- Announcement made in October 2023 to develop a 0.2 million sq ft Free Trade Warehousing Zone (FTWZ) on vacant land within Cybervale, located at Mahindra World City, Chennai.

- Development of MTB 6, a multi-tenanted building within International Tech Park Bangalore (ITPB), which is scheduled for completion by end-2024.

- Constructions have also commenced for the data centres in Navi Mumbai and ITPH to address an increasing demand for modern data infrastructure.

- The business trust also plans to start the construction of another 2 data centres in Channai and Bangalore in 2024.

Environmental, Social and Governance (ESG) Efforts:

- From 6th position in 2022, CapitaLand India Trust has rise to 4th position in the Singapore Governance and Transparency Index 2023.

- In GRESB (Global Real Estate Sustainability Benchmark) assessment, CapitaLand India Trust received a 4 Star rating for both its Standing Investments and Development in its 1st year of participation.

- It has also continued to maintain its Grade A rating for the GRESB Public Disclosure Report – highlighting its commitment to transparently report on its ESG practices and providing stakeholders with comprehensive information.

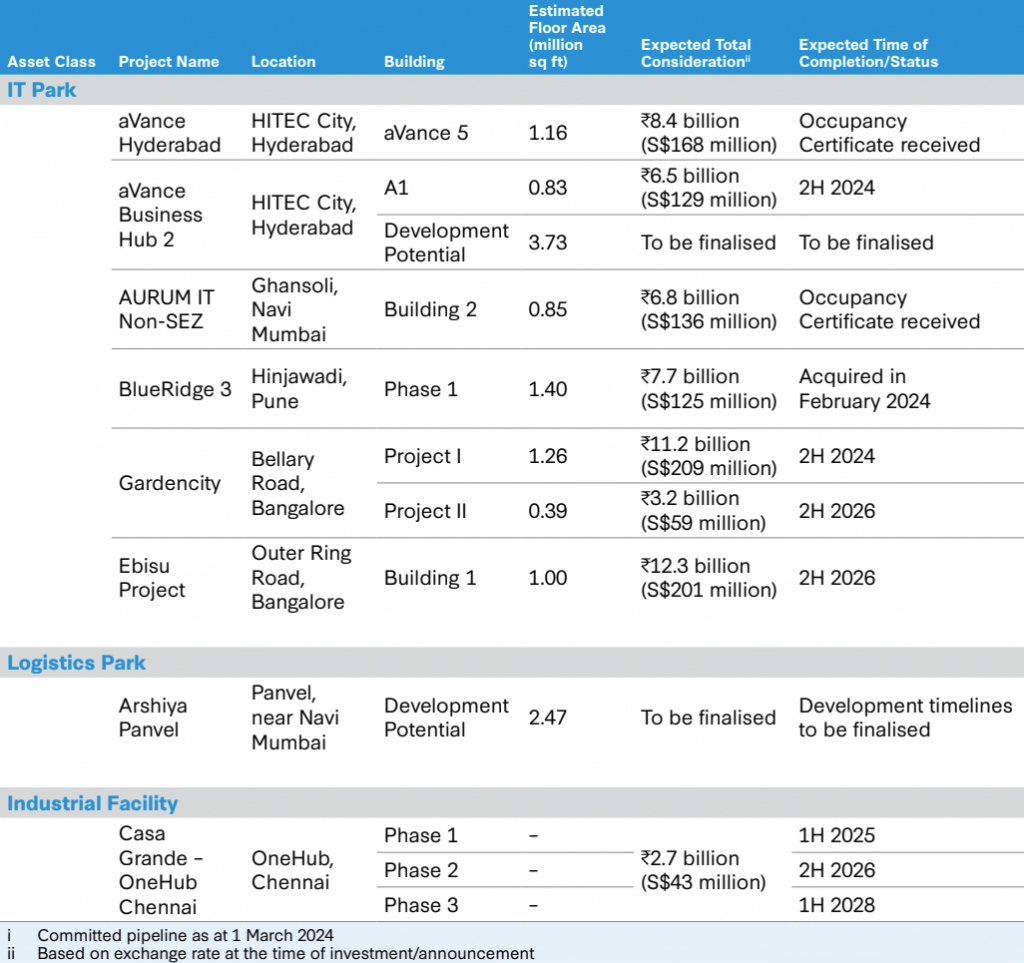

Committed Forward Purchase Transactions:

Image Source: CapitaLand India Trust’s FY2023 Annual Report

Looking Ahead:

- Key progresses and milestones in 2024: (i) Completion of MTB 6 in International Tech Park Bangalore (ITPB) by end-2024; (ii) Newly added assets in 2023 (namely the ITPH Block A, International Tech Park Pune – Hinjawadi, and Industrial Facility 2 and 3 at Mahindra World City, Chennai, have started to generate revenue since January, May, and December respectively), along with recently signed lease agreements in Q4 FY2023 are expected to contribute to a 20% increase in revenue in Q1 FY2024; (iii) forward purchase agreement made in February 2024 with Casa Grande Group to acquire 3 industrial facilities at OneHub Chennai; (iv) completion of acquisition of BlueRidge 3 Phase 1, a multi-tenanted IT SEZ project in Hinjawadi, Pune, in March 2024; (v) Management expects the acquisition of Building Q2, Aurum Q Parc in Navi Mumbai to be completed in 1H FY2024, which will contribute to the business trust’s revenue growth.

- Recent amendments to the SEZ Act (announced by India’s central government, which allows office landlords to designate a portfolio of its built-up office area as a non-SEZ area, subject to certain conditions) are set to increase the appeal of IT/ITES SEZs in India, and help with the business trust’s leasing efforts for 3 reasons: (i) it aligns with the preferences of Global Capability Centres (GCCs), which have emerged as a significant driver for commercial office absorption and generally favour non-SEZ spaces for expansion; (ii) the denotified areas are expected to command higher rentals, offering attractive prospects for office landlords and developers; and (iii) amendments also addresses the leasing challenges faced by IT and SEZ buildings.

- The management is also expecting a strong demand in the logistics/industrial segment, as well as its data centre assets under construction.

Details of CapitaLand India Trust’s 17th Annual General Meeting

When? Friday, 19 April 2024

Time? 2.30pm

Where? Big Picture Theatre, Level 9, Capital Tower, 168 Robinson Road, Singapore 068912

Unitholders have the option to choose between attending the meeting in-person (no pre-registration necessary if your units are held in your CDP account; if your units are held in a custodian account, you will need to get in touch with your brokerage to appoint you to attend the meeting as a proxy), or virtually (which you will need to pre-register here by Wednesday 17 April 2024, at 2.30pm).

I have already signed up to attend the meeting virtually, and will post a summary of it (for the benefit of those who aren’t able to attend) in due course.

Closing Thoughts

For those of you who like to get an exposure into the growing India economy (the country is one that is benefiting from the trade war between the United States and China, where we have seen companies moving their manufacturing out of China and into India in recent months; also, due to the economic headwinds faced in China at the moment, investors have also shifted their funds out of the country and into India to tap onto its economic growth), then this business trust is, in my opinion, one to consider – for its focus on the growing IT parks and data centres.

Furthermore, it has a pipeline of committed forward purchase transactions which will further grow its revenue, and hence, its distribution payout to unitholders in time to come.

On the other hand, however, I understand some retail investors have concerns about the weak Indian Rupee (against the Singapore dollar, which the business trust reports its financial results in). The management is well-aware of this, and are working on trying to grow its revenue and distribution per unit at a faster pace than the depreciation of the Indian Rupee (the CEO, Mr Sanjeev Dasgupta, shared about this during one of the SIAS’ Corporate Connect session in September 2023, which I’ve attended).

With that, I have come to the end of my summary of CapitaLand India Trust’s annual report for the financial year ended 31 December 2023 (i.e., FY2023). As always, I hope you have found it to be useful. At the same time, please note that all the opinions found in this post are purely mine which I’m sharing for educational purposes only. You are strongly encouraged to do your own due diligence before you make any investment decisions.

Related Documents

Disclaimer: At the time of writing, I am a unitholder of CapitaLand India Trust.

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (0)