Apologies for the lack of updates over the past 2 weeks – I have been very busy with other work; among them includes my studying of companies with growth potentials – and today I’ll like to share one of them I’ve just studied – Zoom Video Communications Inc. (NASDAQ:ZM)

While the company was founded back in 2011, most of you probably only started to make use the online meeting platform since last year, when the pandemic struck, leading to companies letting their staffs work from home and meetings were all conducted virtually via the Zoom Meeting platform.

Apart from Zoom Meeting, some of its other products include:

- Zoom Phone – allowing its users to receive, as well as to make calls to people in 44 countries and territories including Australia, Canada, Ireland, New Zealand, Puerto Rico, the United Kingdom, as well as the United States;

- Zoom Chat – which allows for organisations and teams to communicate and collaborate (through messages, and also sharing of images, audio, files, and other content) in groups, channels, or on a one-on-one basis;

- Zoom Rooms – or an online version of a physical meeting room, where participants can come together under one ‘room’ for discussions, sharing (wirelessly); there’s also an interactive white board which participants can use (very much like a white board in a typical discussion room);

- Zoom Conference Room Connector – for those who use conference room systems from other providers such as Poly or Cisco to be able to participate in a Zoom Meeting;

- Zoom Video Webinars – which supports interactive video presentation to up to 50,000 audiences;

- Zoom Developer Platforms – allowing developers to integrate Zoom’s video, phone, chat, and content sharing into other applications;

- Zoom App Marketplace – which brings together integrations built by Zoom, as well as by third-party developers, allowing for users of Zoom’s products to improve their experience with new functionalities;

Zoom Communications was listed since 17 April 2019 at an IPO price of $36.00 – had you invested in the NADAQ-listed company since day one, you would have been hitting on a capital gain of more than 700% based on its closing price of $301.50 on 10 September 2021.

In the rest of today’s post, I’d be sharing with you some of the company’s key financial statistics, debt profile, current financial year results so far, and also my outlook for the company ahead…

Financial Statistics

Zoom Video Communications Inc. have a financial year ending every 31 January. In this section, you will find some of the key financial statistics of the company between FY2019/20 (period between 01 February 2019 and 31 January 2020) and FY2020/21 (period between 01 February 2020 and 31 January 2021):

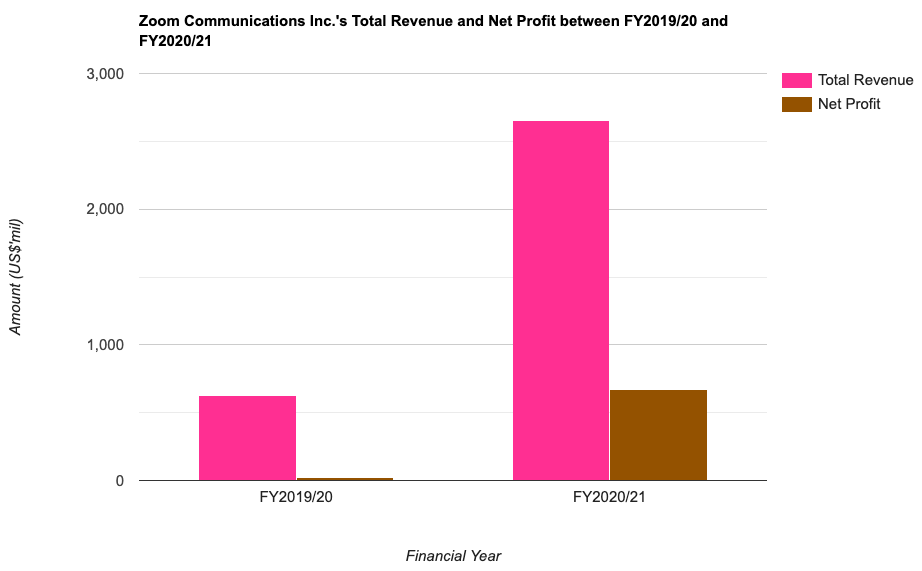

Total Revenue and Net Profit (US$’mil):

| FY2019/20 | FY2020/21 | |

| Total Revenue (US$’mil) | $623m | $2,651m |

| Net Profit (US$’mil) | $22m | $672m |

The company is one of the biggest winners from the pandemic – as companies make use of the company’s video conferencing platform and capabilities to conduct business meetings with their staffs as they work from home, along with individuals making use of the platform to keep in touch with their loved ones when countries around the world were locked down over the course of the year.

Hence, the increased usage of Zoom can be reflected in the stark improvement in its top- as well as in its bottom-line compared to the year before.

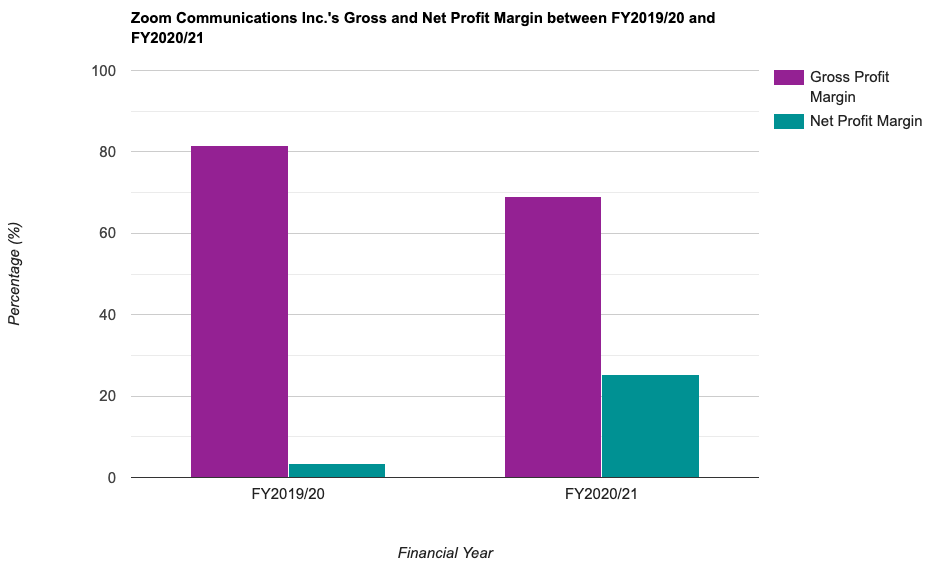

Gross and Net Profit Margins (%):

The following table is the company’s gross and net profit margins which I’ve calculated:

| FY2019/20 | FY2020/21 | |

| Gross Profit Margin (%) | 81.5% | 69.0% |

| Net Profit Margin (%) | 3.5% | 25.3% |

The decline in the company’s gross profit margin was due to a sharp jump in its cost of sales – as the company expanded its data centre capacity to deal with increased usage.

Return on Equity (%):

Return on Equity, or RoE, in layman terms, is a measure of profitability (in percentage terms) the company is able to generate for every dollar of shareholders’ money it uses in its business/es. Personally, my preference is towards those that are able to consistently maintain this statistic at above 15.0%.

The following table is Zoom Communication’s RoE which I’ve computed:

| FY2019/20 | FY2020/21 | |

| Return on Equity (%) | 2.6% | 17.4% |

With its net profit recording a significant improvement in FY2020/21 (compared to the previous year), its RoE also jumped.

Debt Profile

In terms of borrowings, the company does not have any for the 2 financial years I’ve looked at, and as such, it is in a net cash position, as follows:

| FY2019/20 | FY2020/21 | |

| Net Cash (US$’mil) | $344m | $2,993m |

| Free Cash Flow/Share (US$/share) | $0.55 | $4.92 |

Compared to the previous year, both its net cash position, along with its free cash flow per share have also recorded significant improvements – which is good to note.

Key Highlights of its 1H FY2020/21 vs. its 1H FY2021/22 Results

The following table are some of the key figures of Zoom Video Communication’s latest 1H FY2021/22 results (period between 01 February and 31 January 2021) compared against the same time period last year (i.e. 1H FY2020/21 between 01 February and 31 July 2020):

| 1H FY2019/20 | 1H FY2020/21 | % Variance | |

| Total Revenue (US$’mil) | $992m | $1,977m | +99.3% |

| Net Profit (US$’mil) | $213m | $544m | > +100.0% |

| Gross Profit Margin (%) | 70.2% | 73.4% | – |

| Net Profit Margin (%) | 21.5% | 27.5% | – |

| Net Cash/Debt (US$’mil) | +$1,031m | +$1,995m | +93.5% |

I’m sure you’ll agree with me that the company’s latest set of results above is an outstanding one – particularly, I’m encouraged to see that, its gross profit margin have improved compared to the same time period last year. Another thing I like is that, the company’s net cash position have further improved on a year-on-year basis (and compared to the previous quarter 3 months ago, its net cash position have also improved from the +$1,600m recorded at the end of Q1 FY2020/21 ended 30 April 2021.)

Closing Thoughts

The pandemic have really changed the way people work, live, and play. In terms of work, I am of the opinion that hybrid working is here to stay (after all, many are used to working from home after doing so over the past one year or so, with some even cited that they will consider leaving the companies that do not allow them the flexibility to work from home.) Outside of work, many have also been using the Zoom platform to attend virtual courses (to improve themselves), and to stay in touch with their friends and family (one example being virtual meal gatherings) – with many countries still struggling to deal with the pandemic, it seems that over the next couple of years, Zoom’s video conferencing capabilities will continue to be the choice for the workplace (to communicate with staffs around the world), as well as for individuals (where they catch up with their loved ones.)

The company is not without risks – some of them include cybersecurity risks (and it has to continuously invest in the area of cybersecurity to make sure its platform is secure for its users – as any negative news surrounding sensitive information about its users being breached will lead to them migrating to other platforms, and hence a potential loss of revenue), along with challenges coming from both existing, as well as new video conferencing platforms (where they offer more features at even more attractive rates.)

With that, I have come to the end of my sharing today about Zoom Video Communications Inc. I do hope you’ve enjoyed the contents I’ve presented above. Here’s wishing you a great week ahead!

Disclaimer: At the time of writing, I am not a shareholder of Zoom Video Communications Inc.

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (0)