I had a brief chat with a friend of mine last week (who has much more experienced in investing than me) about investing in general. One of the things he shared with me was opportunities available in the Hong Kong stock market currently, and companies he was looking at investing.

Inspired by his sharing, I then spent the past couple of days to conduct some researches to find out two things – companies which I’m familiar with (and I’m pretty sure you’re familiar with the companies as well) that are listed on The Stock Exchange of Hong Kong (HKEX), as well as the basics I need to know to start trading on the HKEX.

I will be sharing with you more about the former in my future posts; today, I’d like to share with you the basics you need to know to buy/sell shares of Hong Kong-listed companies:

1. Trading Hours:

The trading hours on HKEX is as follows:

Market Pre-Open: 9.00am – 9.30am

Morning Session: 9.30am – 12.00noon

Lunch Break: 12.00noon – 1.00pm

Afternoon Session: 1.00pm – 4.00pm

Market Pre-Close: 4.00pm – 4.10pm

This is slightly different from the trading hours on SGX, which is as follows:

Market Pre-Open: 8.30am – 9.00am

Morning Session: 9.00am – 12.00noon

Lunch Break: 12.00noon – 1.00pm

Afternoon Session: 1.00pm – 5.00pm

Market Pre-Close: 5.00pm – 5.16pm

2. Settlement Period:

Just like buying or selling of shares on the Singapore Exchange (SGX), the settlement period is T + 2 – meaning a trade is due for settlement 2 market days after it is made.

3. Bid Size:

For Singapore-listed companies on the SGX, if they are above $$1.00, the share price jumps by S$0.01 – and this is known as the bid size. For example, if Company A’s share price is at S$1.00, the next upward jump is by 1 cent to S$1.01. For share prices between S$0.200 and S$0.995, the bid size is S$0.005, and finally, for share prices below S$0.200, the bid size is S$0.001.

For companies listed on HKEX, the bid size is as follows:

| Share Price Range | Bid Size |

| HKD0.01 – HKD0.25 | HKD0.001 |

| > HKD0.25 – HKD0.50 | HKD0.005 |

| > HKD0.50 – HKD10.00 | HKD0.01 |

| > HKD10.00 – HKD20.00 | HKD0.02 |

| > HKD20.00 – HKD100.00 | HKD0.05 |

| > HKD100.00 – HKD200.00 | HKD0.10 |

| > HKD200.00 – HKD500.00 | HKD0.20 |

| > HKD500.00 – HKD1,000.00 | HKD0.50 |

| > HKD1,000.00 – HKD2,000.00 | HKD1.00 |

| > HKD2,000.00 – HKD5,000.00 | HKD2.00 |

| > HKD5,000.00 – HKD9,995.00 | HKD5.00 |

4. Trading Fees:

When it comes to trading stocks listed in other stock exchanges, besides brokerage fees (along with other fees being charged by the stock exchange), another thing you will want to take note is the custody fees charged by the brokerage firms to hold your shares.

Of the brokerage firms I have an account with – DBS Vickers, DBS Treasures, and FSMone, only FSMone does not have any custody fees. Also, in terms of brokerage fees, it is also lower compared to DBS Vickers and DBS Treasures.

The following table is a break down of charges for every buy/sell order on FSMone trading platform:

| Item | Amount |

| Brokerage Fees | 0.08%, with a minimum of HKD50.00 |

| HK Contract Stamp Duty | 0.10%, rounded off to the nearest dollar (on principal amount) |

| Transaction Levy | 0.0027% (on principal amount) |

| Exchange CCASS Fee | 0.004%, with a minimum of HKD5.00 (on principal amount) |

| Trading Fee | 0.005% (on principal amount) |

| GST | 7.0% (on brokerage fees) |

The following is how fees are calculated, should you decide to buy 100 shares of Alibaba (SEHK:8866) at HKD207.00:

| Item | Calculation and Amount |

| Investment Amount | HKD20,700.00 (HKD207.00/share x 100 shares) |

| Brokerage Fees (0.08%, with a minimum of HKD50.00) | HKD20,700 x 0.0008 = HKD16.56 (as brokerage fees is less than the minimum of HKD50.00, a minimum of HKD50.00 is charged) |

| HK Contract Stamp Duty (0.10%, rounded off to the nearest dollar) | HKD20,700 x 0.0010 = HKD20.70 (if rounded up to the nearest dollar it will be HKD21.00) |

| Transaction Levy (0.0027%) | HKD20,700 x 0.000027 = HKD0.56 |

| Exchange CCASS Fee (0.004%, with a minimum of HKD5.00) | HKD20,700 x 0.00004 = HKD0.828 (as the fee is below the minimum of HKD5.00, the minimum of HKD5.00 is charged) |

| Trading Fee (0.005%) | HKD20,700 x 0.00005 = HKD1.04 |

| GST (7% on brokerage fees) | HKD50.00 x 0.07 = HKD3.50 |

| Total: | HKD20,781.10 (if you convert this to SGD based on the exchange rate of HKD1.00 = SGD0.18, it will be S$3,747.59) |

Apart from checking out fees charged by the various brokerage platforms I have an account with, I also checked out fees charged by some of the other popular brokerage platforms, including SAXO, as well as the new brokerage firm Tiger Brokers – the former have a slightly higher brokerage fee compared to FSMone (at 0.15%, with a minimum of HKD90.00 for every buy/sell transaction), while the latter have a lower brokerage fee compared to FSMone (at 0.06%, with a minimum of HKD15.00 for every buy/sell transaction.)

Personally, I will be making use of FSMone to buy/sell on the HKEX, as I do not want to go through the hassle of opening another brokerage account.

5. Share Price Streaming:

Do take note that for FSMone, share price streaming for HKEX stocks is delayed by 15 minutes. For those of you who are looking to day-trade in the stock exchange, this may be a problem. However, if you, like me, are looking to invest in HKEX stocks for the mid- to long-term, then this is not a problem (at least for me.)

6. Minimum Lot Size:

For SGX, one lot equals 100 shares, and the minimum buy/sell is one lot.

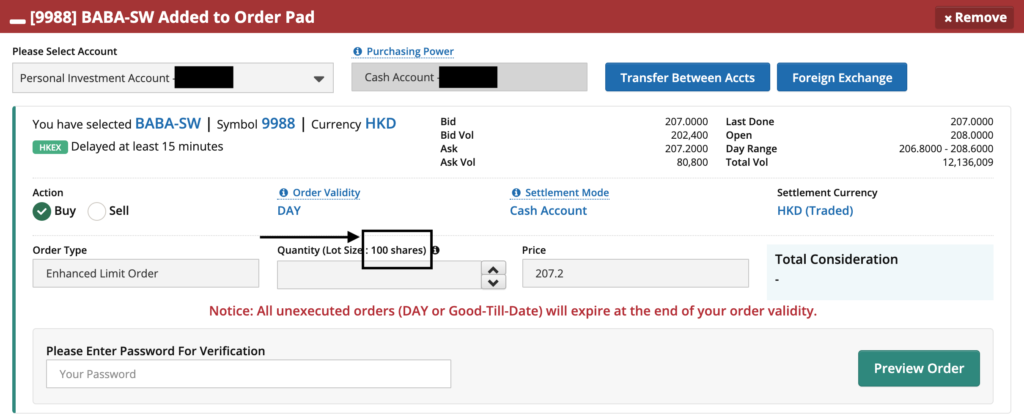

However, for HKEX, the minimum lot size is dependent on the companies you’re buying/selling, and if you are using the FSMone trading platform, you can find the minimum lot size at the page where you key in your orders:

7. Tax on Dividends Paid out by HKEX-Listed Companies:

From my understanding, all dividends received (as a shareholder of Hong Kong-listed companies on the HKEX) are not taxable. Also, there are no dividend handling fees being charged by FSMone (if you use the trading platform to buy your shares.)

This is the same as dividends received from Singapore-listed companies on SGX, where they are not taxable.

In Conclusion:

For those of you who are reading this post, and have prior experience in buying or selling shares in the HKEX, is there anything else I should know that I did not list them above? Please feel free to let me know either in the comments section below, or you can send me a message here.

If you are new to the Hong Kong stock market like me, I hope today’s share will give you a better understanding of it.

REITs vs Banks: Which Investment Delivers More for Income Seekers?

If you thought 2025 was a wild ride for the stock market, wait until you see 2026! With not only the uncertainty of interest rate changes and geopolitical tensions but also a military operation by Israel and the United States against Iran, it's set to be even more turbulent.

So, with all this in mind, which is the better choice for income investors: REITs or banks?

I'm honoured to be re-invited by Dinah Poehlmann from Your Finance Mind for a fireside chat on Zoom this year, where I'll be sharing my insights on this topic.

Join me on Thursday, 19 March 2026, from 8pm to 9pm, as I offer my thoughts and answer any questions you may have.

Best part? Registration is completely free! Secure your spot now through the link below:

👉 Sign Up Now and Mark Your Calendars

Are You Worried about Not Having Enough Money for Retirement?

You're not alone. According to the OCBC Financial Wellness Index, only 62% of people in their 20s and 56% of people in their 30s are confident that they will have enough money to retire.

But there is still time to take action. One way to ensure that you have a comfortable retirement is to invest in real estate investment trusts (REITs).

In 'Building Your REIT-irement Portfolio' which I've authored, you will learn everything you need to know to build a successful REIT investment portfolio, including a list of 9 things to look at to determine whether a REIT is worthy of your investment, 1 simple method to help you maximise your returns from your REIT investment, 4 signs of 'red flags' to look out for and what you can do as a shareholder, and more!

You can find out more about the book, and grab your copy (ebook or physical book) here...

Comments (12)